COLLATERAL MANAGEMENT

Collateral Risk Management Scope, Challenges, and Systems

- Inherent Risks of Collateral

- The Important of Collateral Risk Management

- Scope of Collateral Risk Management

- Resources Needed for Collateral Management

- Key Components of Robust Collateral Management Systems

- Aggregate Collateral Data from Many Systems to Improve Oversight

- Collateral Tracking and Collateral Analysis to Improve Efficiency

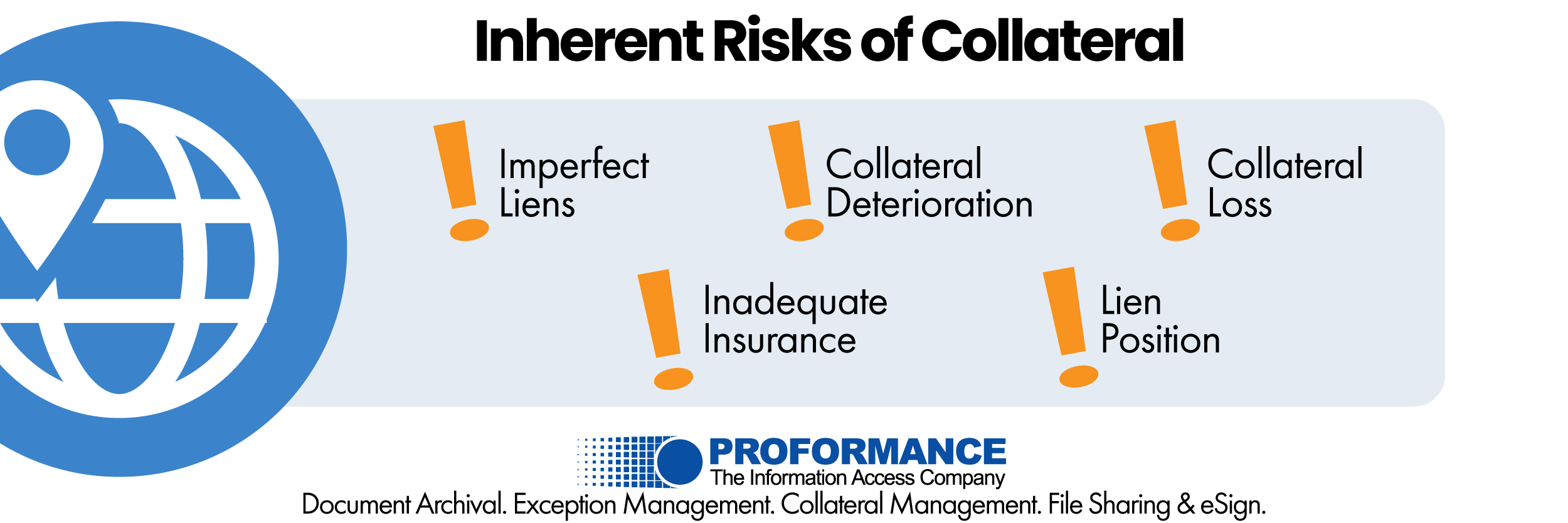

Inherent Risks of Collateral

Banks and credit unions take pledged assets as collateral on extensions of credit to secure a loan and limit the risk of loss to the financial institution, but securing a loan doesn’t fully mitigate all risk of loss. Imperfect liens, collateral deterioration or loss, inadequate insurance, and lien position are just a few ways that the financial institution can realize a loss if the borrowers and guarantors default and the bank or credit union is forced to liquidate the collateral to resolve the debt. For this reason, collateral risk management is a critical function for ongoing safety and soundness, and banks and credit unions focus significant resources to identify, manage, and mitigate risk.

The Importance of Collateral Risk Management

Community Banks and Credit Unions

Strong risk management practices are essential to the health and ongoing operations of your financial institution. The cyclical nature of market cycles — from commercial real estate loans to residential real estate to asset-based lending to agriculture lending — present inherent risks to all banks and credit unions, but this is even more pressing for community-based financial institutions who are not “too big to fail.”

The value these financial institutions bring to their communities is far-reaching. Oftentimes, they have the unique perspective and flexibility to lend to niche markets in their footprint, providing a valuable revenue source to the financial institution and a critical funding resource to local business owners. But, The burden of sound collateral risk management can be a significant drain on scarce personnel resources at smaller institutions.

Appropriate board and management oversight for proper portfolio management - from credit underwriting to credit risk review to concentration of credit management - is key in meeting regulatory standards for safety and soundness. Quite simply, it is essential for ongoing operations.

Scope of Collateral Risk Management

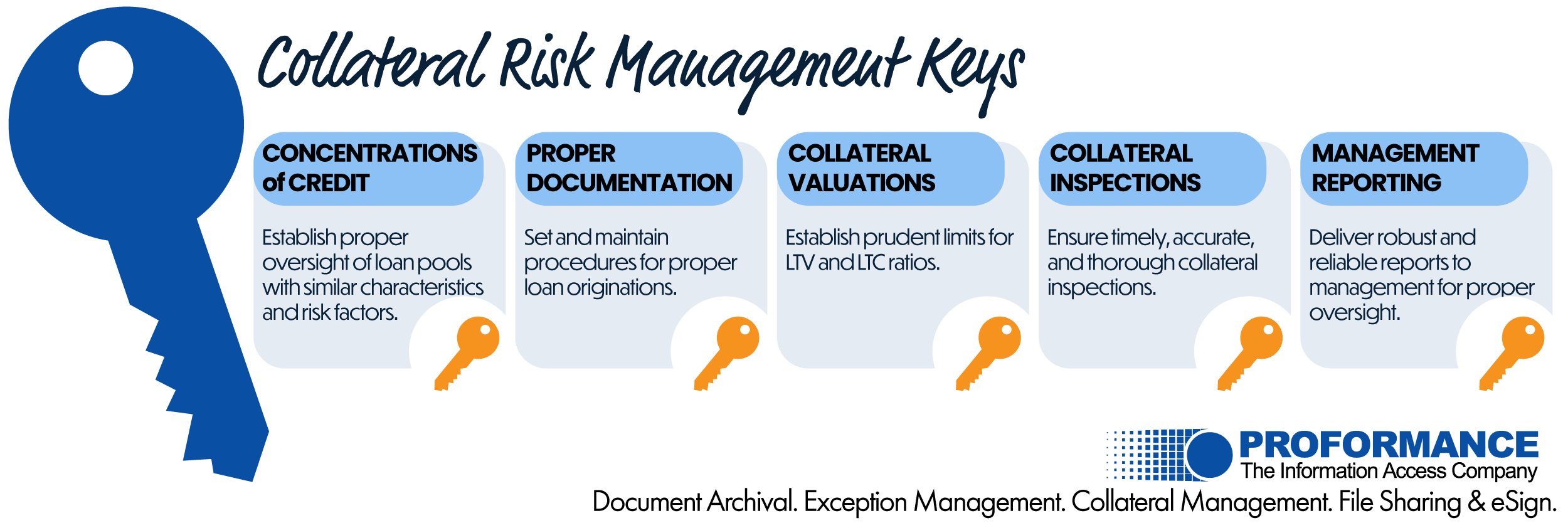

The regulatory agencies set out guidance for the scope of credit risk management with special attention paid to the identifying, management, and mitigation of collateral risk. The OCC even sets their guidance out by collateral type. While the scope of a sound collateral risk management approach, like the scope of credit risk management in general, will vary in size and complexity based on the institution’s size and environment, sound collateral risk management focuses on the following key areas:

Concentrations of Credit

Establish a process for tracking concentrations of credit, our large pools of credit risk defined by common collateral type, industry, or other shared risk factors. Concentrations of credit can cause irreparable harm to financial institutions as loans that share these similar risk factors can default in large numbers if a particular industry or area suffers damage. For example, we need to look no further than the 2020 pandemic and the damage done to the tourism and restaurant industry. A bank or credit union with a significant concentration of lending in either industry quickly had a large-scale deterioration in credit and collateral quality, with the ability of their borrowers to repay their obligations changing in a matter of days and weeks.

Proper Documentation: Perfecting the Collateral Lien

Financial institutions must set up and maintain procedures for proper loan originations, ensuring that documents properly perfect the lien on the collateral and protect the value of the collateral to the institution in the future. Organized and accurate tracking of in-force insurance and ongoing UCC records are just two examples of the continuing management to limit credit and collateral risk.

Collateral Valuations: Determining Loan-to-Value Risk

Banks and credit unions must establish prudent limits for loan-to-value (LTV) and loan-to-cost (LTC) ratios as another means to limit risk with special consideration given to loans that exceed established regulatory limits like the supervisory loan-to-value SLTV limits. LTV and LTC are frequently calculated by hand by a loan officer or loan operations team member; therefore, the risk of human error is greater and can lead to an inadequately secured loan.

Collateral Inspections: Timely and Thorough

Proper oversight and administration procedures for timely, accurate, and thorough collateral inspections are a critical component of collateral risk management. Collateral inspections can include the inspection of asset-based goods to ensure the borrower is keeping to the terms of their borrowing base certificate or can include site inspections of collateral under construction. Collateral under construction can pose unique risk to a bank or credit union if the project is delayed, funds are misused, or construction quality is sub-par.

Management Reporting: Robust and Reliable Reporting

Finally, banks and credit unions must establish robust and accurate management information reports delivered to them in a timely manner. Quality management reports are key to proper oversight to ensure that staff are adequately identifying, managing, and mitigating credit and collateral risk for the institution.

Resources Needed for Collateral Management

The need for robust credit and collateral risk management has led to expanding loan operations and credit risk departments. With inadequate technology to fill the need, personnel specialists were added in order to maintain weekly, monthly, and quarterly collateral risk management functions.

The need for robust credit and collateral risk management has led to expanding loan operations and credit risk departments. With inadequate technology to fill the need, personnel specialists were added in order to maintain weekly, monthly, and quarterly collateral risk management functions.

Rather than managing your lending portfolio using a patchwork of systems, spreadsheets, people, and processes, technology is catching up, allowing banks and credit unions to leverage collateral management systems that can both assist in managing credit risk and improve efficiency, ease frustrations, speed up processes, and, ultimately, improve your net interest margin, too.

Collateral Management Software

A collateral management system can be a powerful tool for management. So, how do you evaluate systems and choose the one that works best for your financial institution? Let’s take a look

Key Components of a Robust Collateral Management System

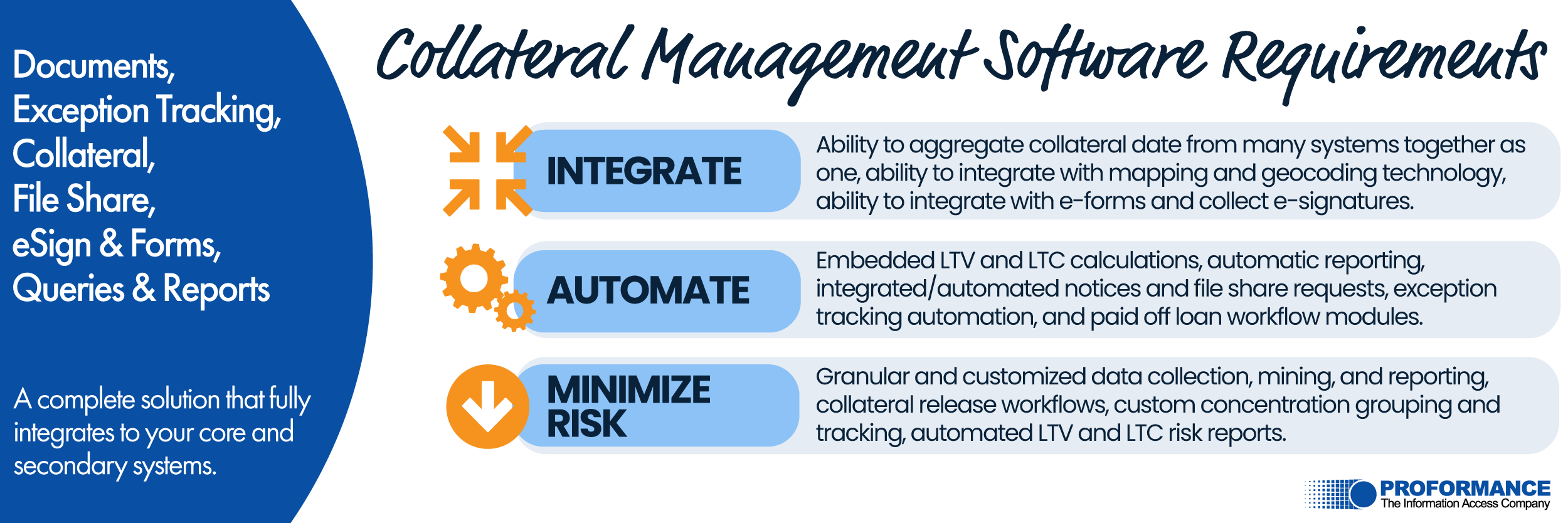

Robust collateral management software should integrate, automate, and minimize risk. Here are some considerations when evaluating collateral management software.

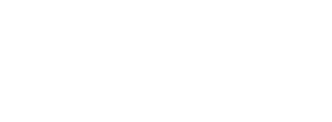

Integrate: Aggregate collateral data from many systems together to manage as one.

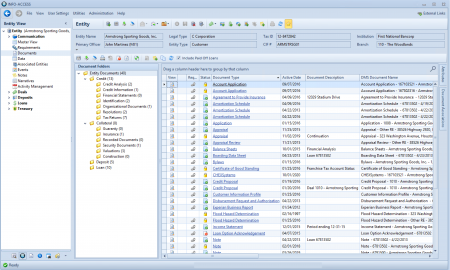

- A management information system that is tightly integrated with your institution’s core processor (like Jack Henry’s Silverlake or Symitar, FIS Horizon CSI, Fiserve, or similar) simplifies and streamlines the day-to-day work of employees throughout the organization.

- Presenting a deep range of data from the core keeps employees working in a central application as opposed to flipping from the core to a document management system (DMS) to work managed through spreadsheets. Look for a system that can represent data from your core in a clean and logical layout so that users don’t have to flip around to complete their work.

- By integrating data, a collateral management system can present paid off loans in a work queue where staff can notify a lender of the payoff, prepare a collateral release, automatically remove tracked exceptions, and generate a notice to the customer thanking them for their business without ever leaving the application.

- Leverage these systems to evaluate your loan for HVCRE compliance and track those loans that should be reported. Look for integrations like this so that your collateral management efforts are centralized in one application rather than various spreadsheets.

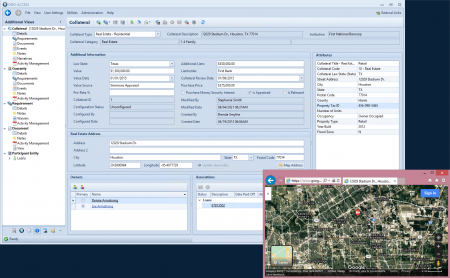

- Your collateral management software should make repetitive work functions, like the geocoding and address mapping of collateral, quick and easy. Select a collateral management system that can streamline these functions.

Automate: Collateral Tracking and Collateral Analysis Software to Improve Efficiency

- LTV and LTC calculations are more complicated than one loan divided by one value. A strong collateral management system should provide accurate LTV and LTC calculations even where cross-collateralizations exists, allowing your team to stay within regulatory and in-house guidelines. Look for a solution that will provide relational and record-specific calculations viewable on the customer record and integrated with reports.

- Producing collateral management reports can be a time-consuming manual process where employees must record information on spreadsheets and email them around to related departments. Leverage the power of a collateral management system to produce custom reports and schedule them to run automatically so that your staff can focus on other projects.

- Integrated exception tracking and document integration ensures that your collateral files are properly maintained at all times. For example, a robust collateral management system should monitor the status of insurance, UCC recordings, and similar documents on an ongoing basis. When insurance expires or UCC documents needs to be refiled, the system should notify your team of the work required, automatically place pending items on management reports, and even automatically notify your customers that updated document is needed.

- On the subject of notifying your customers that updated documents, like proof of insurance, are needed, a modern collateral management system should also have integrated file-sharing capabilities that allow your customer to both receive the request for updated documentation and submit the document via digital file share to your institution.

Minimize Risk: Granular and Customizable Oversight for Management

- Concentrations of credit come in many varieties, and most collateral systems aren’t customizable enough to drill-down or track the information that fits your institution. A collateral solution that’s flexible enough to track concentrations of credit by NAICS code to custom collateral concentration codes down to specific attributes that collateral records share will allow your institution to properly manage risk exposures. With this level of granularity, you’ll be able to search, monitor, track, and produce reports on collateral that share the same builder, are in the same subdivision development, or any other unique risk factor that is specific to your bank or credit union.

- Prevent accidental collateral releases on cross-collateralized loans with a solution that clearly presents and tracks cross-pledged collateral. Eliminate user error, like overlooking or misreading a note, by tracking cross-pledged collateral cleanly within the collateral management solution.

- Modern collateral management systems should offer unlimited customized data collection capabilities so that your institution can establish what risk data needs to be collected based on each type of collateral in your portfolio. Further, once new risk factors are established and collected, you should be able to immediately search and report that data directly through the system without developing a database report to mine the data and without requesting and waiting for an enhancement from your software provider.

INFO-ACCESS Collateral Management System

Whether you’re regulated by the OCC, the Federal Reserve, a state banking regulator, or the NCUA, our robust and flexible collateral management system provides the integration, automation, and customization, that you need to thoroughly manage your collateral. We specialize in providing ready-to-go solutions for community-based institutions, and we partner with our clients to set up a collateral management solution that was designed to meet the needs of commercial real estate lending, agriculture lending, asset-based lending, and consumer and residential lending, affording you operational efficiencies without on-staff developers.

Learn more about the INFO-ACCESS enterprise management information system and view the features and functions that will improve your institution’s processes.

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.