Apr 3, 2020

Apr 3, 2020

What Financial Institutions Can Learn from Blockbuster.

What can financial institutions learn from Blockbuster?

Financial institutions have already been working to keep up with the digital demands of their customers, but what happens now?

Keeping up with the Joneses

The convenience factor of managing finances via smartphones and tablets have been service additions made from the largest national banks to the smallest community banks as customers come to expect more capabilities from the palm of their hand. In our current environment, these digital tools shift from convenience, a product offered to keep up or ahead of your competitor down the street, to critical — a product essential to maintaining a working relationship with your customer.

It’s in this environment – a public health crisis forcing the world to learn and implement social distancing tools simultaneously – that the fabric of our culture will be changed forever. But, it’s not the first, or last time, in our history that a disruptive change has upended our way of life, changing the business landscape forever. The key: learning from the past and changing our current focus.

A Look Back

In the 90’s, Blockbuster was the king of video rental. The chain had more than 9,000 video stores, 84,000 employees, and 65 million registered customers. Ten years later, the chain no longer existed.

What happened? A failure in vision and change. It’s the fundamental difference between management and leadership.

In 2000, then-CEO John Antico passed on the opportunity to buy a three-year-old streaming service startup named Netflix. In 2008, Blockbuster CEO Jim Keyes told the Motley Fool, “Neither RedBox nor Netflix are even on the radar screen in terms of competition.” In 2010, Blockbuster filed for bankruptcy. Too late to the party in taking a hard look at the changing environment. Too focused on the management of their current business without a vision for the future.

Will there be financial institutions that repeat these same mistakes? Most likely so. But, it doesn’t have to be this way.

Learn from History

Social distancing is the business disruption for financial institutions in much the same way as the internet age was for video rental companies. Proper leadership, with a vision for the future that’s focused on finding opportunities, will allow institutions to transform their operations, not just survive until they can go back to business as normal. Institutions that thrive will find opportunities to expand and grow now and carry those innovations forward as new tools in their toolkit of success.

Our Advice

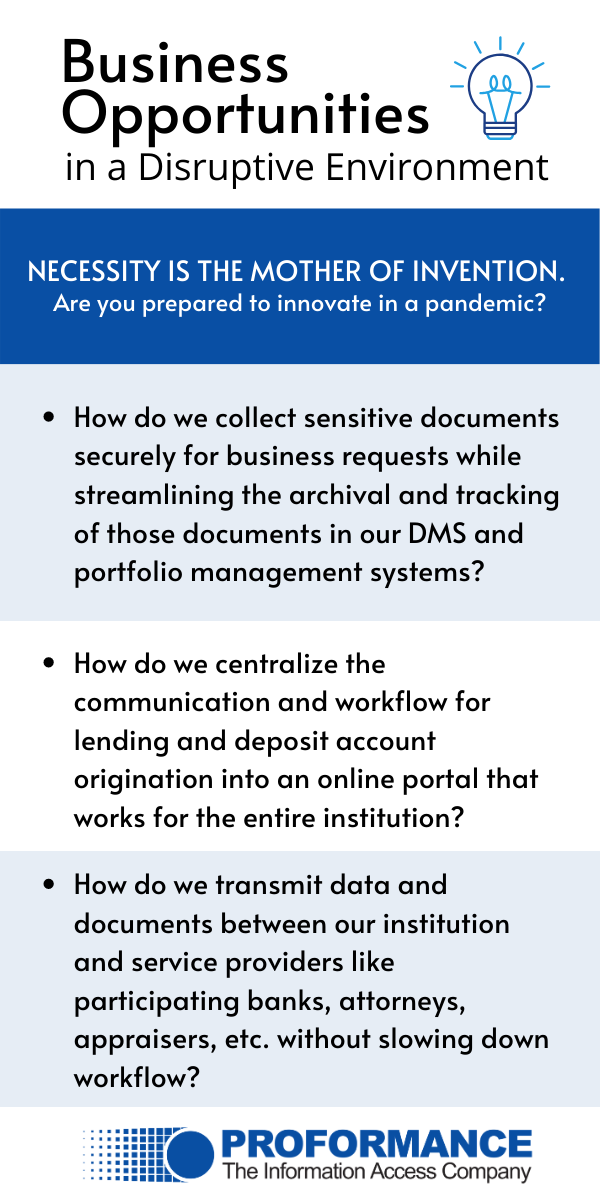

Use this opportunity to reap the full benefit of the proverb: necessity is the mother of invention. Don’t hunker down, find ways to survive, and wait for this to pass. Innovate.

Find solutions to the new problems your customers are facing. Solve them and wrap those solutions into your company culture going forward because there’s one thing that’s certain — the business landscape will be changed forever with this disruptive event.

Will you be Blockbuster or Netflix?

Opportunities in a Time of Disruption

Have a discussion with your team to evaluate opportunities for innovation that will help your institution thrive even during the pandemic. Here’s a discussion list to get you started:

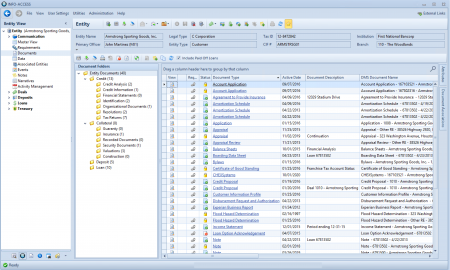

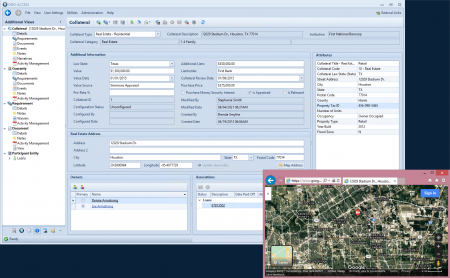

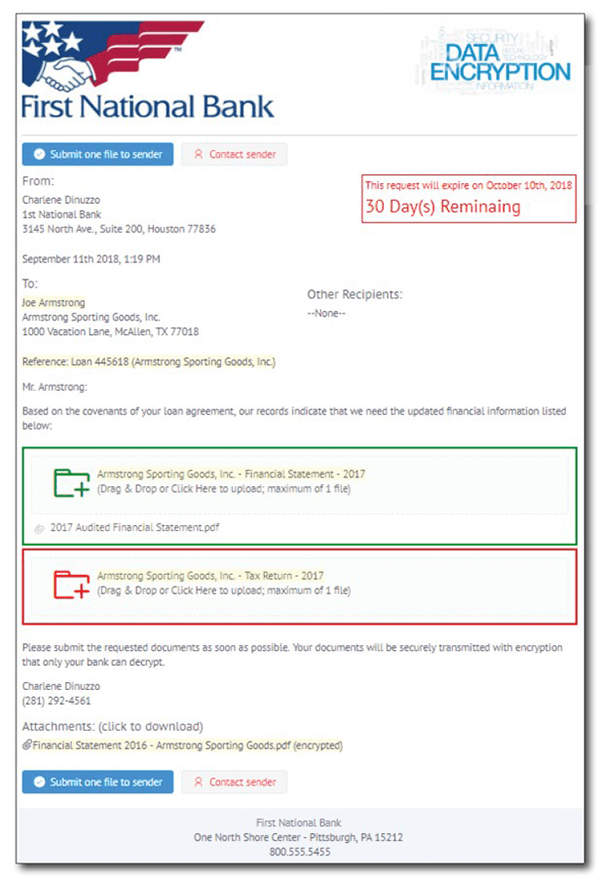

- How do we collect sensitive documents securely so we can continue serving our customers? How do we collect data and documents for new loan evaluation or new deposit account origination while maintaining or improving our operating efficiency? Can we streamline the archival and tracking of that data and those documents in our DMS and portfolio/enterprise management systems?

- How do we centralize the communication and workflow for loan and deposit account origination into an online portal that works for the entire institution?

- How do we transmit data and documents between our institution and service providers, like participating banks, attorneys, appraisers, inspectors, etc., without depending on a siloed product that slows down workflow and causes user frustration?

- How do we improve our own operational efficiency by improving processes so that exception tracking, document management, portfolio quality oversight, collateral management, concentration oversight, and asset quality management doesn’t become a burden managed through spreadsheet after spreadsheet costing us time, energy, and personnel? How do bring data and documents together to automate tasks and improve oversight?

About Us

PROFORMANCE partners with financial institutions to provide configurable information management and workflow systems for front-facing customer interactions and back-end operational efficiency. Our systems integrate many functions across the institution into one best-of-breed system that is ready to go — no staff developers or process building needed, making our solutions ideal for community-based financial institutions.

Provide your customers with a streamlined online portal as robust as your large national competitors, improve efficiency and workflow and ease tensions with automated workflows and integrated tracking for operations departments, and improve oversight with portfolio management, analysis, and business insight tools.

We stand ready to assist you with innovative and integrative solutions for each of the business opportunities listed above to position you for success. Learn more at proformance.com or set up a personal consultation with our president by calling (281) 292-9000.

Article Sources

Ash, Andy. “The Rise and Fall of Blockbuster.” Business Insider, January 16, 2020. https://www.businessinsider.com/the-rise-and-fall-of-blockbuster-video-streaming-2020-1.

Chong, Celena. “Blockbuster’s CEO Once Passed up a Chance to Buy Netflix for Only $50 Million.” Business Insider, June 17, 2015. https://www.businessinsider.com/blockbuster-ceo-passed-up-chance-to-buy-netflix-for-50-million-2015-7.

Sinek, Simon. (3/27/2020) These are Not Unprecedented Times [Video file]. Retrieved from https://youtu.be/6spNnsD-XOY