FILE SHARING for BANKS &

CREDIT UNIONS

How to Connect Document Requests, File Sharing, Exception

Tracking and Document Management

What is File Sharing?

Today, the term file-sharing can cover many functionalities, but in its original form file-sharing was the ability to distribute or provide access to, aka share, digital files with an audience. The uses for file-sharing and the capabilities of file-share providers have grown in recent years. The term file sharing may also encompass the act of file syncing and sending file requests.

Types of File Sharing

Let’s start with a look at two types of file sharing.

Peer-to-Peer (P2P) File Sharing

Peer-to-Peer File Sharing is when a file is shared directly between two computers over a network with no servers involved. P2P file-sharing has risks though as your computer is connecting directly with other computers. This means that users could mistakenly download malware or other harmful material.

Cloud Storage

Cloud storage services have become very popular because instead of sending files directly to another person, files are sent to a server to be stored. From there, files can be scanned for viruses and then downloaded by another user. Popular cloud storage services include OneDrive, Google Drive, and DropBox.

File Sharing in Financial Institutions

File Share Adoption at Banks and Credit Unions

Financial institutions are beginning to leverage file share solutions in connecting and working with their customers. Banks and credit unions were slow to adopt file share services to start as they weighed and managed security risks. However, improvements in file sharing security combined with customer demands have allowed banks to implement secure file-sharing services. The COVID-19 pandemic only further pushed the need for financial institutions to have secure file share solutions.

How Financial Institutions Use File Sharing

Customer Pressure for File Sharing

Customer Pressure for File Sharing

The ability to receive files from customers was one of the earliest needs that banks and credit unions identified. As their customers began adopting file sharing services in their own businesses and daily lives, they began pressing their financial institution to modernize to offer them a digital solution to submitted documents. If they were sending copies of their W2’s and P&L’s to their accountant to prepare tax returns, why couldn’t they send the prepared tax return on to their bank or credit union rather than mailing it or dropping it off face-to-face with their lender

Secure File Sharing Portals: A One-Way Street

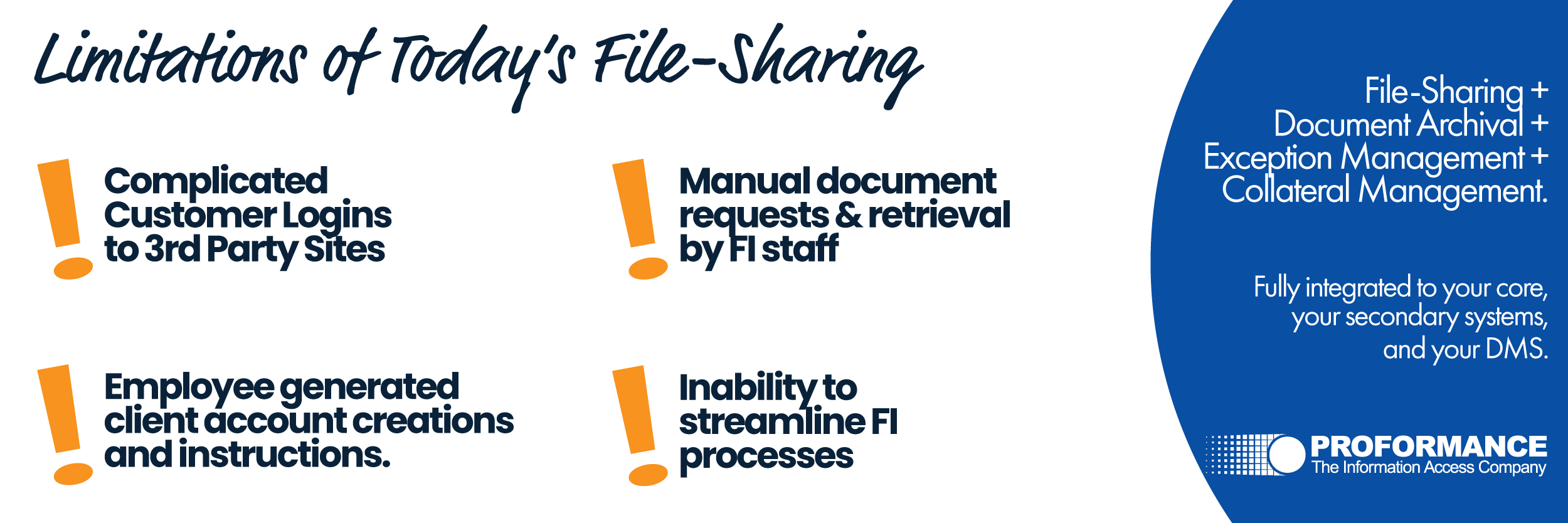

To accommodate customer requests, yet still meet the security needs of the institution and comply with regulator standards, banks and credit unions went on the hunt to find solutions to fit the bill. Most institutions came up with file share services that met their security policies but that have turned out to be nothing more than a one-way file share portal.

Yes, they keep their customers from driving to the branch or post office to deliver their documents which, meeting the immediate customer pressure they faced but these solutions have two critical downfalls:

- They require customers to create complex usernames and passwords and to login to minimally-branded third-party sites in order to upload documents.

- They require employees to separately request and provide instructions on how to use the service and separately monitor, retrieve and archive submitted documents.

The Burden of Stand-Alone Document Share Services

Because these file share services require the customer to initiate the file upload, this process requires the lender or account officer to initiate the request via a separate phone call, letter, or email. In these requests, the employee must provide their customer with instructions and links to access the file share portal, set up their account, and then upload the files.

On top of that employees must monitor the institution’s file share account for incoming documents from various customers, retrieve and download those documents, distribute the documents to various team members or departments, ensure the documents are archived (aka imaged) to the document management system (DMS), and ensure that the documents are used to clear outstanding exceptions, or ticklers. Whether the document share retrieval and processing burden fall to one employee, like the lender or account officer, or a whole team, like loan operations and deposit operations, it's abundantly clear that this file share solution is just as disjointed and time-consuming to the financial institution as their handling of paper documents.

Financial Institutions Desire for Integrated File Sharing Solutions

It hasn’t taken long for banks and credit unions to go on the search for a file-sharing solution that can streamline the work of requesting, retrieving, archiving, and syncing documents. With their eye on efficiency, management teams are pushing employees to do more with less, and everyone, from the frontline to the executive leadership team, has seen the advantages of integrated solutions. An integrated solution would not only make the work faster it would also eliminate human error and reduce tensions between employees.

So, how can banks and credit unions connect document requests, file sharing, exception tracking, and document management?

Total File Share Automation: A Guide

A total file share workflow solution must start with document requests and end with ongoing exception management with functionality that allows for the collection of forms and signatures, the routing of documents for review and approval, and the archival of incoming documents baked in. Let’s look at some key functionality that sophisticated digital file-sharing services can provide to financial institutions as you search for the best solution.

Requesting Documents for Loan Origination, Account Opening, and Exception Management

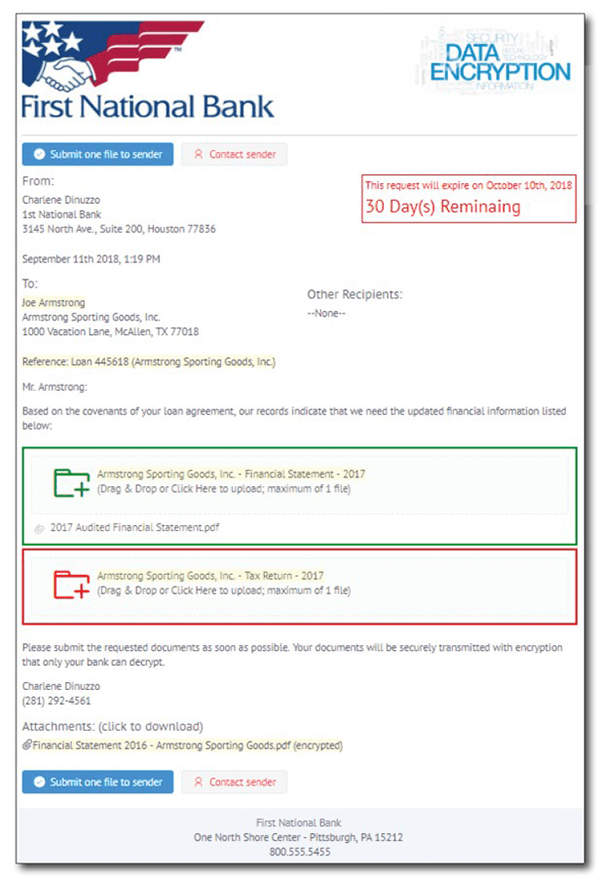

Secure file-sharing software for banks and credit unions should allow employees to kick off a request to a single customer or send system-generated bulk requests. Either way, the process should accommodate requests for single or multiple documents.

Ad Hoc File Requests

Single requests generated ad-hoc (when necessary) allow lenders and account officers to request documents for new loan originations, modifications, or renewals or for opening new deposit accounts. Requests should be able to be customized to suit the situation and the employees

Bulk Requests

File sharing for banks and credit unions should go a step farther than ad hoc requests. Automated bulk requests allow financial institutions to collect new documents by account type, loan type, or other relevant criteria. With the ability to request one or more documents from many customers at once, automated bulk collection works perfectly for requesting PPP documentation, stop or hold forms, or expiring financial and insurance documents.

File Share Attachments

Sophisticated file sharing software should also allow lenders and account officers to attach documents to the initial file request whether that request is being generated ad hoc or by bulk. The ability to include attachments, like account and loan disclosures, means that employees don’t have to send the information via a separate email.

File Share Security

File share security improvements haven’t stopped, which is why you should now evaluate the functionality and ease of use more rigorously to give your customers and team members the most features. Sophisticated file share services can allow customers to upload requested documents into a secure portal by simply dragging and dropping the documents. This means that you no longer have to direct your customers to a third-party site with a suspicious link, and they don’t have to create a complicated user account. Dropped documents can now be immediately encrypted.

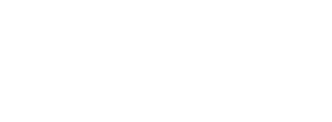

Document Collection and Retrieval

The employees on your team have more important things to focus on than monitoring a file share portal for incoming documents. A fully integrated file share system can notify employees when requested documents are received. And the system should be able to retrieve those documents from the document share service for you, eliminating a repetitive task in the institution.

Quality Reviews for Shared Documents

What if you want to perform a quality review on incoming documents? Compare file sharing services to see which ones are able to automatically route collected documents to a quality review portal where an employee can verify that the document meets the policy guidelines of the institution before approving, flagging for corrections, or rejecting the document.

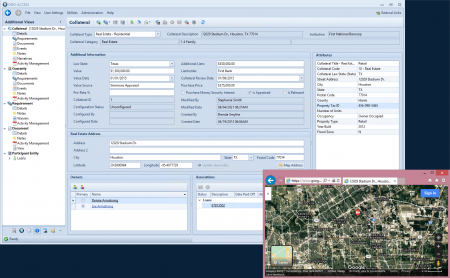

Automatic Document Archival to your Document Management System (DMS)

Once retrieved, reviewed, and approved, vet the file sharing service for the ability to automatically archive incoming documents to your bank or credit union’s document management system. We nearly always see financial institutions with siloed solutions where an employee, not an integrated system, must move documents from point A (file share storage) to point B (archived storage).

Syncing Documents with Exception Tracking

To bring the workflow full circle, determine if archived documents can automatically integrate and sync with your bank or credit union’s exception tracking software. The ability to sync documents in the DMS with exception tracking means that incoming documents satisfy outstanding exceptions as documents are archived, eliminating another siloed process of manually updating tickler tracking records as new documents are received. Going forward, as documents expire (like in the case of annual financials or expiring insurance), the solution you choose should be able to automatically kick off new digital file share request using that bulk request functionality we mentioned up top.

For the Win: Secure File Sharing Driven by Exception Tracking with DMS Integration

Document and information management shouldn’t be a financial or operational burden. Follow the guide above and your institution will have a total solution that is easy for your customers and more efficient for your team.

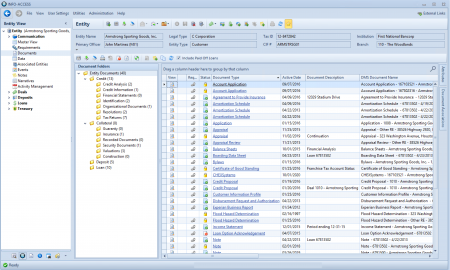

Learn about INFO-SHARE

We passionately pursue working with our customers to create best-of-breed solutions to improve operational efficiency. Our service, INFO-SHARE, is digital file-sharing driven by document exception tracking with DMS integration, and it brings a total workflow solution to a problem currently patched by stand-alone products. Let us know if you would benefit from a demo and Q&A session.

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.