DOCUMENT MANAGEMENT

Document Management Systems are the Key to Workflow

- Integrated Document Management Systems

- What is a Document Management System?

- Common Problems with Document Management Systems

- Document Management Systems for Business Workflow

- Benefits of an Enterprise Content Management System

- How Document Management Systems Improve Efficiency Ratios

- What DMS Works Best for Your Bank or Credit Union

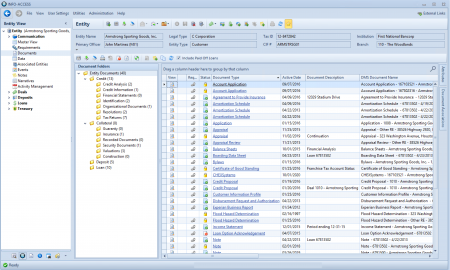

Integrated Document Management Systems

Is your document management system setting you up for success when building workflows for your loan and deposit teams? We hear this over and over again from financial institutions: “We want a system where everything works together.”

We hear you, and we’re here to tell you that your document management system’s functionality is critical in reaching this goal. Your DMS should give you the ability to track documents for new and existing customers, and it should integrate and automate the following work functions: exception tracking, file share requests, notices to customers, document sharing among the team, and management reports. Let’s take a deep dive into document management systems and how to set them up for more than document archival.

The Basics of a DMS for your Bank of Credit Union

What is a Document Management System?

A document management system, or DMS, is a system used to receive, track, manage and store documents. You may call the DMS your document archive at your bank or credit union, but your DMS is the digital storage of documents. If you don’t have even a basic one already, your regulator is probably prioritizing this goal for you. Why? A DMS allows you to safely move document storage from paper files stored in an expensive secure room to an electronic platform. As bank exams, audits, day-to-day business functions, and customer interactions become remote affairs, this allows you to store and access files across the institution securely and even provide secure remote access to specified regulators and auditors.

But, your document management system is more than a document archival. Your DMS should be viewed as a strategic component to enterprise content management and workflows, a component that allows for document imaging and archive, automated workflows, document sharing and collaboration, and record retention management.

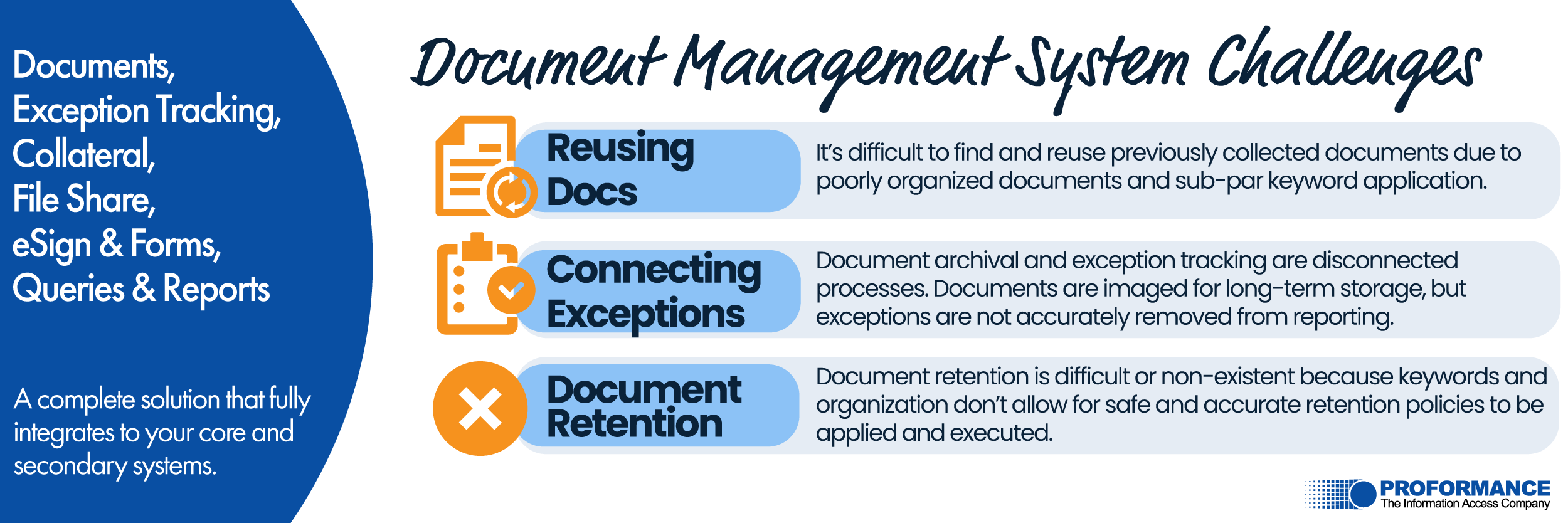

Common Problems with Document Management Systems

All too often, document management systems at banks and credit unions are not well organized. Users fail to properly name or separate documents due to lack of understanding or time constraints, opting instead to lump all documents for any given loan or deposit into a bulk package with a generic document type name, like “Loan Packages”. Document packages organized in this fashion are useful only in the respect that the paper file is now digitally available for viewing as a group, but any further workflow efficiencies are lost due to the poor structuring. Let’s look at some efficiencies lost.

Reusing Existing Documents for New Accounts and Loans

Your customers provide many documents during loan or account origination or during ongoing portfolio management that can be reused for other purposes as you manage their relationship. For example, primary identification documents, like driver’s licenses for individuals or certificates of organizations for businesses, can be reused when opening a new account provided that the existing document is unexpired and can be easily located. In addition, tax returns and other financial statements that are still in date need not be collected again from your customer if you already have them in file. And, the same holds true, depending on your institution’s loan policy, for credit reports. But, if you’re unable to find these documents easily, quickly, or at all, you may be forced to ask your customer to provide the documents again, reflecting poorly on your institution in the customer’s view as they wonder why you can’t keep up with their information.

Connecting Exception Tracking with the DMS

Tracking critical documents for deposits and loans is a key function in properly securing loans, managing portfolios, and limiting risk. If your document management system isn’t well organized and your institution suffers from improperly named or improperly grouped documents, then you likely also have an uphill battle tracking exceptions. This problem only worsens because most institutions track exceptions on siloed systems like spreadsheets or tickler tracking applications.

This means that the burden of tracking exceptions and keeping tickler records clean and accurate falls to your employees. These employees spend significant time keeping your tickler system or your exception tracking spreadsheets and reports manually in sync with documents from the DMS. The personnel allocation devoted to this essential work function is a drag to your institution’s efficiency. An organized DMS that can connect with exception tracking can automate the process and free up your employees to work on more critical projects.

When a document management system is set up to work within your enterprise content management system, your documents are cleanly, accurately, and granularly recorded in a manner that will support:

- Automated tracking of what documents are missing from the file, like a trailing recorded DOT.

- Automated tracking of when documents (like financial, insurance, UCCs, and similar) expire and need to be updated by your customer.

- Automated ability to produce notices via email or print that request new documents like those listed above.

- Automated exception tracking and reporting for lenders, account officer, operations, and management.

Document Retention

A poorly organized DMS also means that your bank or credit union will find it hard to follow document retention rules. With many different documents lumped in one package, or with documents poorly named or dated, your institution will find it difficult to clearly purge documents as they fall past your document retention timelines. This leaves your institution open to added risk, since failing to properly purge documents means that you are still legally liable to produce them upon request, which can be a time-consuming task to take on.

Document Management System Workflows

How do you avoid the pitfalls of a document management system that slows down your team? Here are some key tips:

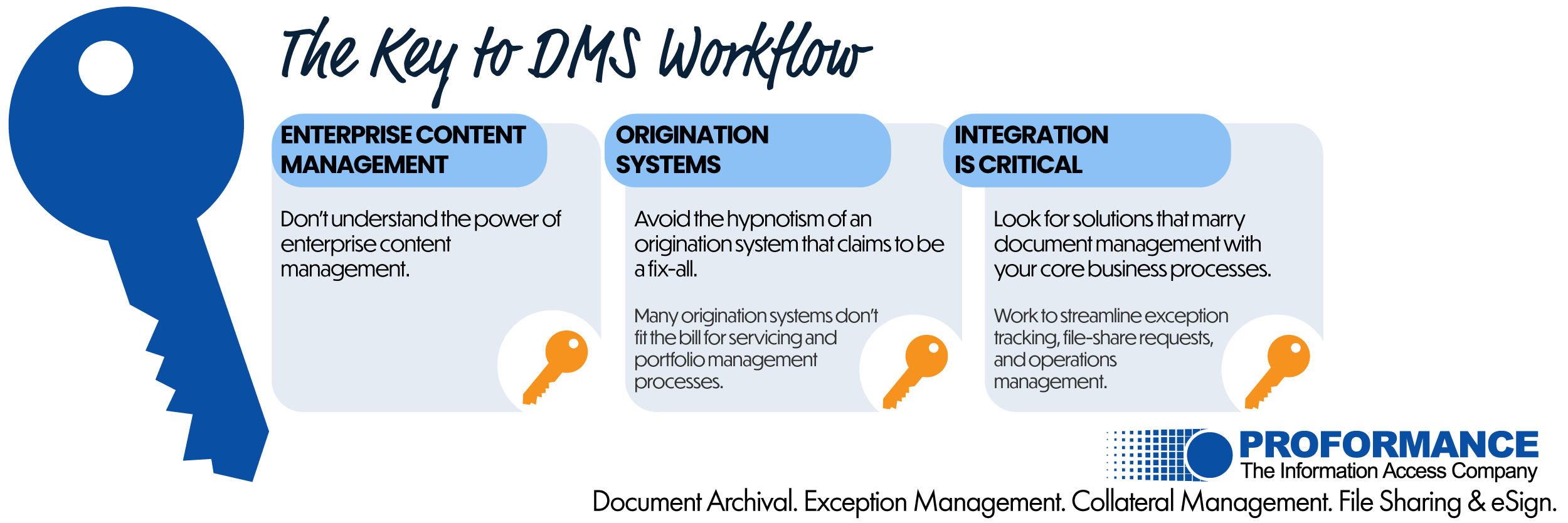

A DMS that Integrates: Enterprise Content Management

First, don’t underestimate the power of an integrated document management system and a true enterprise content management system.

The business process between you and your customer begins and ends with documents – even in our digital world and regardless of if your business with them is on the lending or deposit side of the house. If you truly want to streamline your customer and internal processes, recognizing that the heavy lifting must be done with a document management system that supports those efforts is key.

A Word About Loan and Deposit Origination Systems

Loan and deposit origination systems have their place in your workflow, but avoid the hypnotism of an application that traffics too heavily in data-collection as your fix-all. Data input and output capabilities, like those needed to collect information for a new loan and then output credit memos and document prep instructions or those needed to open a new deposit account and then output account documents, are certainly necessary solutions. But, without a system that can collect, create, track, and sync documents with your long-term document archival you’ll find yourself doing double work when it comes to moving documents from your origination applications to the DMS, and triple work when you get to organize and review the documents again for exception tracking and file management purposes.

Work Towards Enterprise Content Management

Set your target on obtaining an enterprise content management system that does more than store documents for digital viewing and archival. The documents you collect are a living part of your portfolio management, meaning that if your DMS is simply a digital archive then you’ll be relying on the power of personnel to evaluate, track, and maintain loan and deposit files.

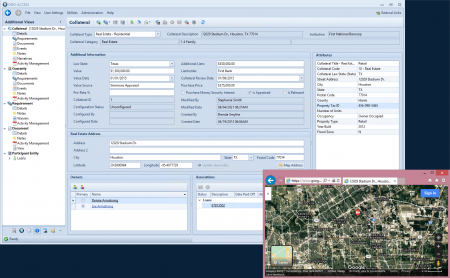

A solution that marries document management with exception tracking, collateral management, file-sharing, customer notices, document retention management, and more means that your system, not employees, are monitoring documents for you. With this level of granularity, your team no longer devotes time to evaluating documents, updating spreadsheets, and producing reports.

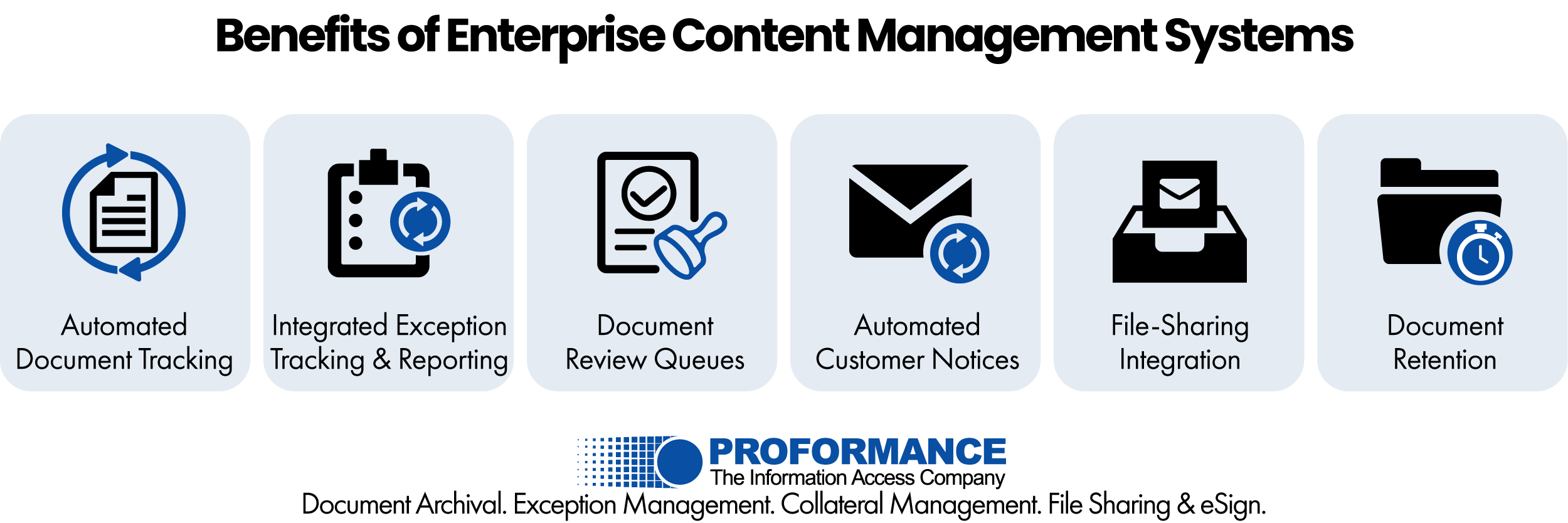

Benefits of an Enterprise Content Management System

So what components should you be able to leverage from a document management system sophisticated enough to serve your enterprise content management needs, and what workflow automation should you get from such a solution. As a best-of-breed provider of such solutions for financial institutions, we can tell you for sure that you should gain:

Automated Document Tracking

Your DMS should enable you to automatically track the status of documents in file and present to you which documents are expired, still active, or have document content issues. The ability to track documents in a more sophisticated manner than a simple archival by document name and data only enables you to link documents in file with your exception tracking and management reporting to streamline everything.

Integrated Exception Tracking & Reporting

By collecting all the pertinent information for each document, your document management system and exception tracking should be able to share information. This means that as documents in file expire, like for ongoing financials, exceptions can automatically appear on management reports and in lender work queues. And when new documents are submitted, the act of archiving a document to the DMS should be enough to automatically clear the connected exception by the system, not an employee. By connecting document management with exception tracking, your financial institution eliminates the redundant work of your employees keeping two separate systems in sync.

Document Review Queue: Routing Document for Approval

A sophisticated system should allow all users to upload documents to the DMS so that you speed up the process of document archival. Using rules-based review queues, your team can identify documents that are new to the system and flag and route those documents to a queue for document review and approval, ensuring every document added meets institution standards.

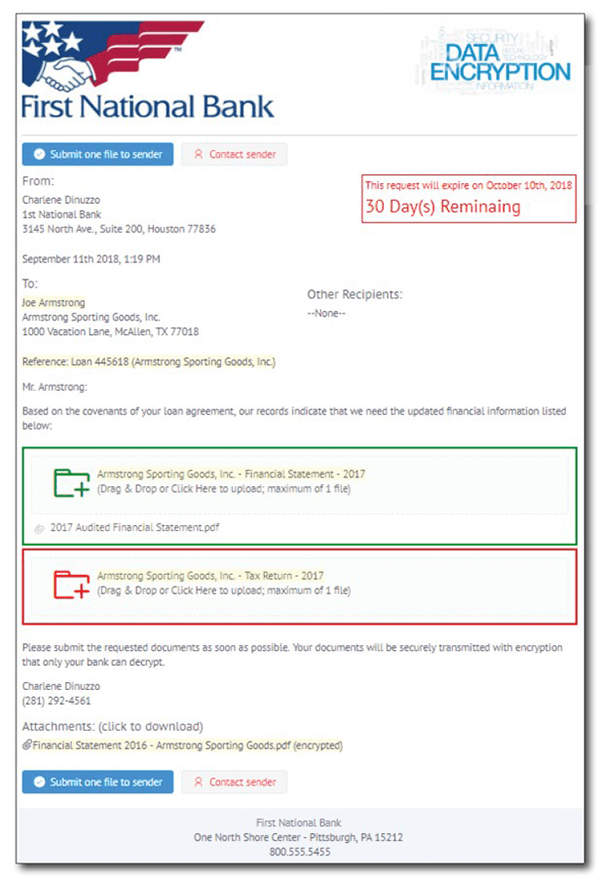

Automated Customer Notices

A system capable of connecting and automating exception tracking and reporting for loans and deposits should also allow you to produce notices as documents in file expire, eliminating one more manual task your employees bear today. Ensure that your enterprise content management system can allow you to automatically produce mail or email notices to your customers as documents in file expire.

File-Sharing that Integrates with Your Document Management System

On top of automating document tracking and document archival, modern systems should provide you the ability to integrate file sharing requests with your customers. These solutions should kick off an automated request to your customer for updated documents and include a file-sharing drop link. Rather than your lenders and account officers having to create that request manually. On the backside, the system should collect the documents for you, rather than depend on your staff to check and retrieve documents. The solution should also route documents that your customers submitted via the file share link to a review queue for document review and approval, too. Once approved, the DMS should automatically archive those documents and sync them with outstanding exceptions.

Document Retention

Finally, look for a system that offers granular document retention management so that you can purge individual documents from your files as each document satisfies your bank or credit union's document retention rules.

How Document Management Systems Improve Efficiency Ratios

Properly managed, sophisticated document management systems built to serve as true enterprise content management systems improve your institution’s efficiency ratio, making a direct impact on your bottom line. A system that can actually connect the workflow from document management to exception tracking to customer notices to file share management, to document retention means that your employees spend less time shuffling documents and matching up siloed systems or disparate tracking spreadsheets.

Your employees will find that the DMS is more accurate, easier to use, and a benefit to their day as they are freed

up for other tasks, reporting will be more timely and accurately, and tensions between departments will diffuse as your no longer searching for those documents that are “in the mail”.

What Document Management System Works Best for Your Bank or Credit Union

Our final piece of advice: Vetting solutions that will carry your team from origination through document archival requires careful consideration and a thorough understanding of how documents are used and transferred around your organization.

- Remember to add more to your document management functionality shopping list than document archival and retention.

- Involve loan and deposit operations and lenders and account officers to understand bottlenecks and time drains on business functions that are connected with document management as outlined above. These groups can offer valuable insight on where you stand to improve operational workflow and ease tensions between teams.

Any system that doesn’t natively contain a DMS or natively integrate with your document management system may not be the do-it-all solution you envision. Need help navigating this process? We provide solutions and consulting to help.

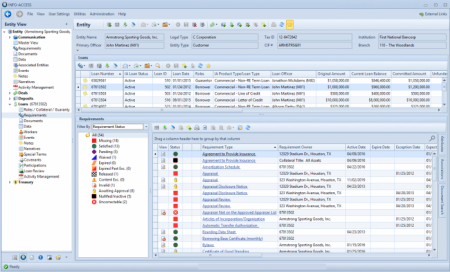

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.

See INFO-ACCESS in ACTION now.

Request your on-demand video

overview now.