Nov 4, 2021

Nov 4, 2021

Exception Management Software: 7 Features and Functions to Empower Your Team

Is your bank or credit union struggling to manage exceptions for new and existing loan and deposit accounts? Are you evaluating exception management software to improve operations? Ever-growing compliance and regulatory requirements make the business of maintaining client deposit and loan accounts increasingly complex. You must meet these standards in order to meet regulatory exam and audit expectations so that your financial institution continues safe and sound operations. But, the work of satisfactorily meeting each requirement to open any new loan or deposit is tedious, and then maintaining, tracking, reporting, and managing those relationships can be a significant burden for a loan or deposit operations team.

How do you maintain accurate exception tracking that benefits, rather than drags down, your bank or credit union? Read on for the seven features and functions you need to solve your exception tracking mess.

Seven Features and Functions of Exception Management Software that will Accelerate Operations for your Bank or Credit Union.

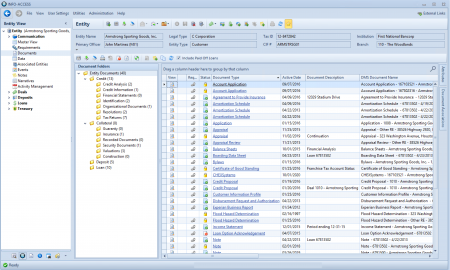

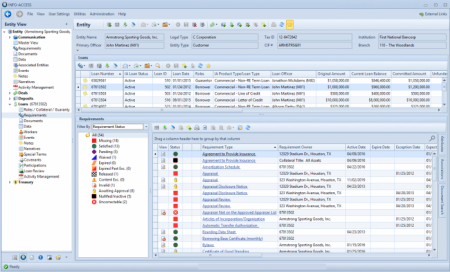

1. Customer-Centric Organization

Group, organize, view, and track documents and exceptions in a customer-centric view. Most systems organize information around keywords or by exception or document type. Your team will benefit from an exception management system that organizes information within the customer, loan, and deposit accounts they manage every day. Open a customer view to see an overview of their entire relationship, including all documents, exceptions, collateral, and guaranties associated with them.

2. Exception Tracking powered by Document Imaging

Let your document management system power your exception tracking so that when a document is added to your document imaging it automatically clears the associated exception. Most financial institutions maintain siloed document imaging systems and exception tracking tools. Marry these business functions together and improve your bank or credit union’s accuracy and efficiency.

3. Interactive Exception Queues

Give your lenders and deposit account officers better tools to monitor and clear exceptions. Your exception management software should allow users to pull a list of their exceptions at any time to allow them to see an up-to-date accounting of their loan and deposit file management. Most financial institutions are forced to send out group reports that are prepared and reviewed by a central department once a week, but an interactive queue that is always accurate and available allows all users to better manage their portfolios.

4. Color-Coded Exception Statuses

Go beyond providing a simple list of exceptions to your team. Use a system that organizes your tracked requirements in an easy-to-use, easy-to-manage structure. Tracked items that are marked with color-coded exception statuses make viewing and managing relationships, loans, and deposits simple and fast. View if tracked items are in the file, missing, expired, and more with a robust exception management system.

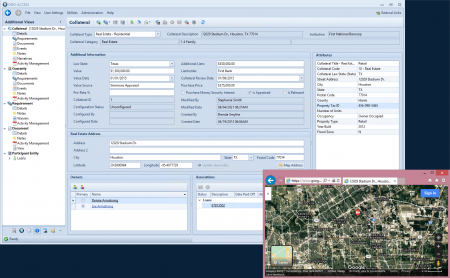

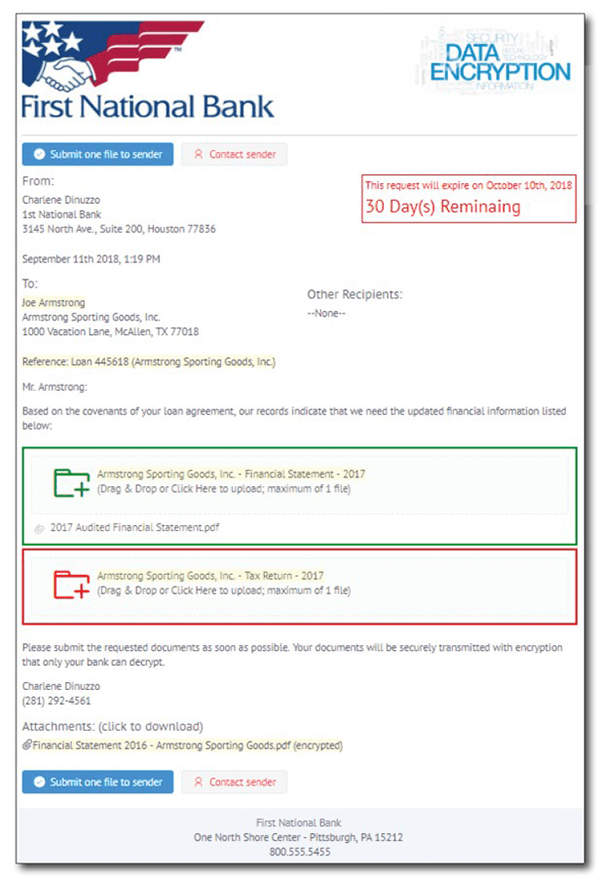

5. Upload Documents with Ease

Allow all users to easily upload one or many documents. Adding documents to a document imaging system shouldn’t be difficult. Allow users to drag and drop documents onto exceptions or into customer files to easily import them into your document archive. All users will find this a quick and easy solution to clearing exceptions or adding documents to the archive. But, users should just have one method of adding documents. The easier it is to add documents to the system the more complete and accurate records become. Collect documents via import, desktop scanning, barcode readers, document sweeps, file imports, and more.

6. Review and Approve Incoming Documents

By giving all users the ability to add documents to automatically clear exceptions, the operation functions of your bank and credit union will be streamlined, but you’ll still want the ability to review and approve new documents for quality control. Find an exception management system that can automatically flag and route new documents to a review and approval queue so that designated staff can be sure that new documents meet your internal policy standards.

7. Automated Reporting

All too often, exception reports have to be compiled by your loan and deposit operations personnel, and they spend hours comparing your siloed exception tracking to your siloed document imaging system to make sure that documents didn’t get missed as they were added to the archive. An exception management system that is powered by document imaging should also include the ability to automatically update reports to free up your team for more important work. On top of that, reports that automatically update as exceptions are cleared mean that you can print a report right before a meeting and know that it’s up-to-the-minute accurate.

Accelerate Business Process Efficiency

How will your financial institution benefit from an enterprise content management system that connects exception tracking to document imaging? The proof is in the numbers:

Our clients report:

- Their efficiency ratio is 7 points lower within the first year.

- Exceptions decline by 60% after year one.

- And, that this new enterprise content management solution required no new or fewer FTEs to install and maintain.

Learn more about PROFORMANCE

Improve your institution’s efficiency, simplify your day, and ease tensions between departments with INFO-ACCESS by PROFORMANCE. INFO-ACCESS is a complete enterprise content management system where exception management is powered by document imaging. INFO-ACCESS organizes and integrates everything – data from your core, documents from your document management system, exception tracking, collateral management, events, notes, notices, analysis, and more. Get your on-demand video demo of our solutions today, and let’s start a discussion about how we can accelerate your operations.

Learn more about our solutions and request an on-demand video demo now.