Nov 24, 2020

Nov 24, 2020

The Best Tools for Credit Officers: Document, Exception, and Collateral Management and Tracking

Document, Exception, and Collateral Management Tools for Credit Officers

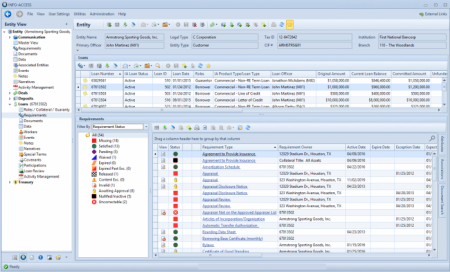

Managing the loan origination, credit analysis, loan servicing, and portfolio management activities of your bank or credit union is an ongoing effort for Chief Credit Officers that is made more complicated by the patchwork of systems in use. A solution that can aggregate data from all the systems in use at your financial institution brings together everything in one single source of record, simplifying your ability to track, report, and manage.

We provide end-to-end workflow solutions and information management systems that mold to your current process rather than molding your institution to a product, making the entire team more productive and giving your customers the touchpoints they expect. Let’s take a look at what you stand to gain with a fully integrated solution.

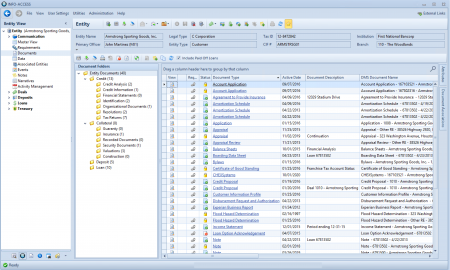

Document Management System

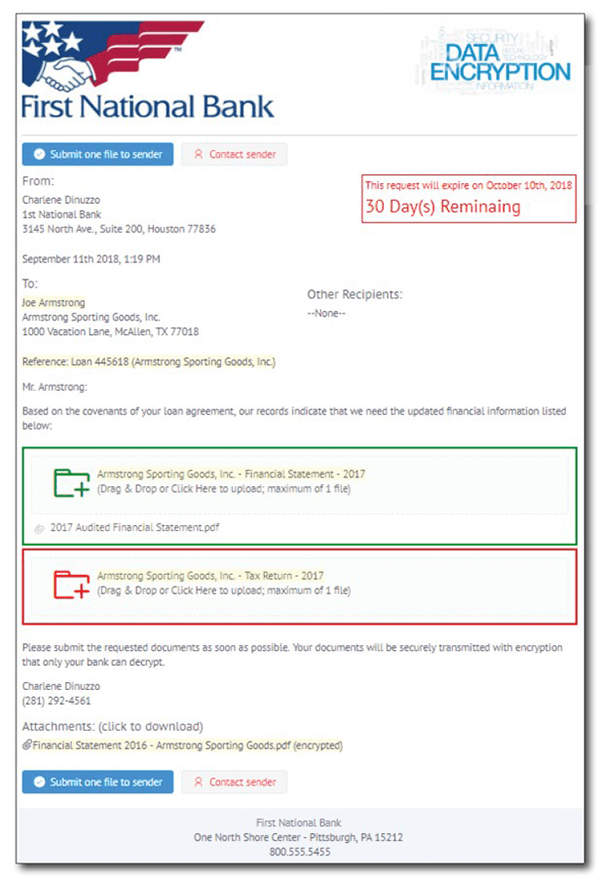

In order to take advantage of powerful workflow gains, your bank or credit union needs to have a sophisticated document management system that can power your key business functions. After all, the business between you and your customer still begins with ends with documents – even in our digital world. Your DMS should be more than a document archival and viewer. With a proper DMS, your financial institution can then leverage:

- Automated tracking of documents like what is missing from the file or what documents have expired.

- Automated notices to customers via email or print that request updated documentation.

- Automated exception tracking for document and policy tracking.

Exception Tracking

Ease tensions between departments as the timeliness and accuracy of exception reporting improves when you connect document imaging with exception tracking in one seamless function. With integrated exception tracking, any user is able to upload a document directly to either the customer’s profile or the officer’s interactive exception summary. That document is both automatically archived to the DMS and automatically clears associated exceptions (tickler records). In addition, added documents can be seamlessly routed to a review and approval queue to ensure that incoming documents meet your policy guidelines. This process also automatically updates management reports, making them up-to-the-minute-accurate.

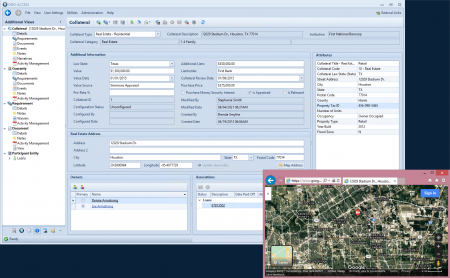

Collateral Tracking and Management

Our information management system can aggregate data from your core as well as from other systems in use at your financial institution like stand-along loan origination systems. On top of that, our enhanced collateral management allows for highly granular tracking and data collection for each collateral record, giving you functionality that includes:

- Cross-pledged loan tracking

- Integrated LTV and LTC calculations, that account for cross-collateralization

- Custom tracking of concentrations of credit

- Unlimited custom data collection that is instantly reportable and searchable

- Geocoding and address mapping of collateral records

Scratching the Surface

You and your team will appreciate the benefits of a completely integrated information management system and the features listed above are just scratching the surface. We’d like to share with you more features that our clients love. Let us know if we can send you a video demo, our total solutions summary planner, or chat briefly about what we offer or visit our Chief Credit Officer Solutions Summary Page now.