Jul 14, 2021

Jul 14, 2021

Collateral Management System: 9 Features and Functions You Need

Community-based banks and credit unions are uniquely qualified to serve the financial needs of the markets they serve. They have the unique perspective and flexibility to lend to niche markets in their footprint and possess a deep understanding of the quality and risk associated with the collateral pledged to loans. Increasingly, financial institutions are searching for a robust collateral management system to aid their lenders, loan operations, credit administration, and management teams in the varied and ongoing efforts to collateral oversight.

Thorough and accurate collateral management is critical in limiting the risk of loss to the financial institution. After all, the compounding risk to a bank or credit union that is forced to rely on weak collateral to cure a loan in default can ultimately result in institutional failure as was seen all too frequently during the Great Recession, and it’s why “Collateral” is a core component of the oft-relied on 5 C’s of Credit when evaluating and managing loans.

Minimum collateral risk management standards will be set by a bank or credit union’s regulatory agency, but the scope of effort to monitor and manage collateral in both an effective and efficient manner grows more and more complex and time-consuming. Financial institutions that do not employ a collateral management system and those using a sub-par collateral software system will find themselves devoted to increasing personnel costs to manage their collateral portfolios. Even so, collateral management and tracking software is a significant expense, especially to community-sized financial institutions. Let’s look at some core functionality and integration features that you should look for when vetting a solution of this type.

Nine Features & Functions for your Bank or Credit Union’s New Collateral Management System

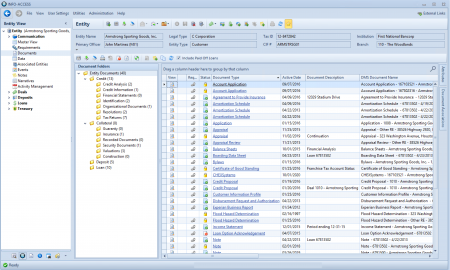

1. Tracking Multiple Collateral Records on One Loan

Managing the institution’s largest borrowing relationships can often mean that a single loan can have hundreds of separate pieces of collateral securing one loan. A robust collateral management solution should provide the ability to track many collateral records for one loan. This tracking should include the ability to collect, track, query, and report on custom data specific and critical to your institution, as well as the capability of aggregating collateral valuations to present a total collateral valuation, loan-to-value analysis, and loan-to-cost analysis at the loan level on an as-needed basis.

2. Tracking a Single Piece of Collateral Pledged to Multiple Loans

Tracking a piece of collateral that has been pledged to more than one loan should be easy, but for many collateral trackers, it’s unorganized and unclear. This presents risks to banks and credit unions where, in a worst-case scenario, the collateral may be released inadvertently. And, the added time and effort spent making sure that required documentation and policies guidelines are met for that collateral record for each and every loan that it is pledged is not to be overlooked.

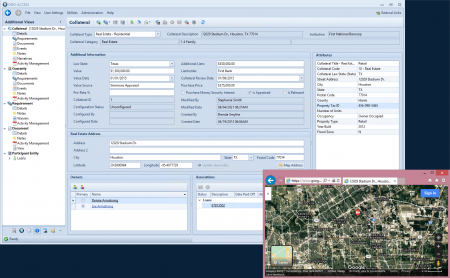

3. Collateral Valuation Tracking: Loan-to-Value and Loan-to-Cost

With collateral software granular enough to properly track and manage the collateral as define above, your team should also get the benefit of integrated, real-time LTV and LTC monitoring that’s reliable for basic loan structures and for complex relationships with cross-pledged collateral. This is importing risk monitoring information that should be presented at each loan view and should be available for supervisory LTV monitoring via reporting tools.

4. Geo-coding, Address Mapping and Viewing Collateral within a Geofence

Expand your collateral monitoring and risk management with the ability to instantly define geocodes on property pledged to loans. Move the process of geocoding from a third-party tool to your integrated collateral management system to streamline work. In doing so, you’ll also have integrated address mapping tools and have the ability to view all your collateral in a defined geographic footprint by simply drawing your target area on a map.

5. Track, Query, Group, and Report Collateral based on Similar Properties

Proper portfolio management and accurate regulatory reporting are critical and drilling down to the needed data can’t be completed with some collateral systems. Make sure your collateral software gives you the ability to track for an unlimited number of defined properties – like occupancy, non-owner vs. owner-occupied status, years in business, the book and page number of the recorded deed, the square footage, and any number of other collateral characteristics that are important to your loan management team. Then, determine that the solution has the ability for your risk management teams to query and use that information for reporting purposes so that your team can better define concentrations of credit, portfolio and loan review scope, and regulatory reporting totals for the CALL report or annual exams.

6. Exception Tracking at the Collateral-Level

A well-organized collateral management solution should have the ability to track collateral-specific documentation and requirements for each piece of collateral, regardless of which loans that collateral is pledged to. Whether it is pledged to one loan, two loans, or ten, lenders and loan operations should be able to archive documents (like appraisals, insurance, and the like) to the collateral record one time and then have that document be viewable on every loan where that collateral is cross-pledged. On top of that, that document should satisfy outstanding exceptions that appear on each loan without having to update each loan’s record or do any extra work.

Put simply, documents added to your collateral management system should automatically sync and clear outstanding exceptions from user work queues and from management reports without having to update a separate system.

7. Viewing Customer, Loan, and Collateral Exceptions

Don’t make your lenders and loan assistants wait for a weekly emailed exception report that someone has to manually prepare and distribute. Empower them to query, view, and clear their own exceptions. A robust collateral management solution should include a work window that will aggregate and present a lender’s exceptions (whether they are specific to the customer, loan, or collateral) in one, centralized work queue, allowing them to query their own exception worklists on the fly, produce their own report, and even upload missing documents to clear those exceptions all in the same location. Streamline the process to view, manage, and work exceptions to lower the hurdles of keeping a clean loan file.

8. Review and Approve New Documents Added to the Document Management System

Collateral management isn’t just about collecting and managing data related to collateral records. Collecting perfected documents for a loan and collateral file is another critical and time-consuming task for lending teams. Vet a collateral tracking system for its ability to integrate with your document archival (also called a document imaging, document management system, or DMS). Further, top-tier solutions should be able to flag and route new documents to the appropriate workers so they can ensure the document meets all of the bank or credit union’s policies and should indeed satisfy outstanding exceptions.

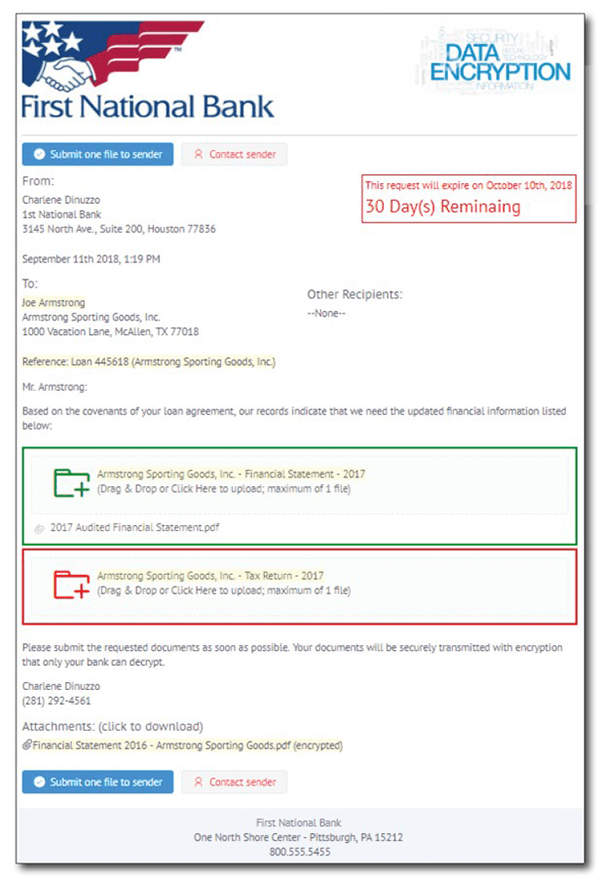

9. Integrated Communication Tools

Finally, look for a system that features integrated communication tools for both internal and external communications. The ability to produce internal email, external email and paper notices based on the status of exceptions, documents, or data that’s specific to a collateral record, loan, or customer further improves the workflow and accelerates process efficiency for your lenders, loan operations, credit administration, and management teams.

How to Choose Collateral Tracking Software

A collateral management system can be a powerful tool for lending teams and management. Vet any potential software for the ability to handle, at minimum, the functionality above, and learn more about collateral tracking and collateral analysis in our complimentary post.

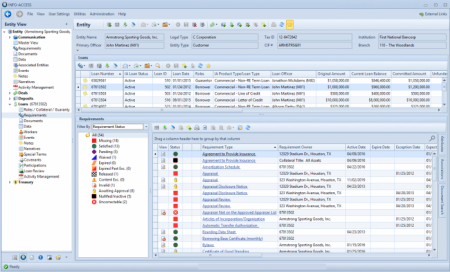

INFO-ACCESS from PROFORMANCE for Collateral Management

PROFORMANCE provides robust and flexible collateral management systems that integrate with your document imaging system, your core, and exception management processes. We specialize in providing ready-to-go solutions for community-based banks and credit unions, and we partner with our clients to set up a collateral management solution that was designed to meet the needs of commercial real estate lending, agriculture lending, asset-based lending, and consumer and residential lending, accelerating your business efficiency.

Learn more about our solutions and request an on-demand video demo now.