Aug 6, 2021

Aug 6, 2021

Document Imaging for Banks and Credit Unions

Is your document imaging system an accelerant or a drag on your bank or credit union’s productivity? Discover 7 benefits of document imaging with PROFORMANCE.

- Integration: Pass Document from Other Applications to Document Imaging

- Reliably Allow Any Employee to Upload Documents

- Make it Easy to Add Documents to the Document Imaging System

- Quality Review Incoming Documents

- Define User Permissions with Granular Security Settings

- Automatically Clear Exceptions by Uploading Documents

- Quickly and Easily Image Large Loan Packages

- Send Customer Letters or Emails Automatically as Documents Expire

- Use Our Storage or Bring Your Own

- Finally Implement Document Retention

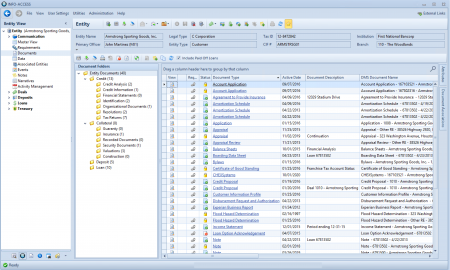

Integration: Pass Documents from Other Applications to Document Imaging

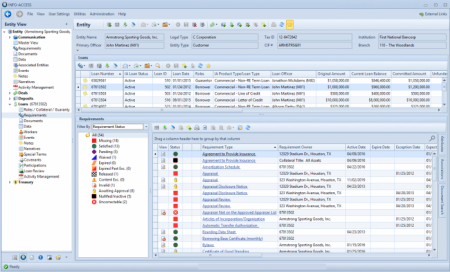

A document imaging system supported by PROFORMANCE can be integrated with many other applications in order to pass documents from the originating application to your document archive. We can help you connect your core, loan origination systems, loan document prep systems, monthly statement production and so much more through APIs, periodic uploads, or even custom programming. Each bank or credit union we partner with has slightly different requirements so tweaking each process to integrate the way you want is nothing new to us!

Reliably Allow Any Employee to Upload Documents

Document imaging is usually reserved for a centralized group because it’s too easy for inexperienced users to incorrectly index documents by assigning document retrieval keywords, selecting the wrong document type, adding incorrect document dates, or making a variety of other mistakes. To keep the document archive clean and usable, banks and credit unions staff and train entire departments to maintain the document imaging system.

Document imaging with PROFORMANCE allows any employee to reliably upload documents to the document management system. How do we do this?

Make it Easy to Add Documents to the Document Imaging System

First, we make it easy to add documents to the document archive. Our tools allow users to drag and drop documents right onto customer names, loan numbers, deposit account numbers, collateral records, and more. By dragging and dropping the document right to the record it should be stored too the document keywords are picked up automatically for the user without them even knowing or understanding the purpose of keywords. Plus, the document types they can choose to image to are dependent on where they drag documents so there’s no fear they accidentally choose a deposit document when adding documents to a loan.

Dragging and dropping isn’t the only way to add documents to the system. They can even import from their computers or scan directly to the system using desktop scanners. There are also many other ways we can easily add documents to the file – we’ll get to those later.

Quality Review Incoming Documents

The automatic indexing to limit user errors is significant, but you still probably want to lay eyes on some or all documents your frontline staff are imaging. With PROFORMANCE, it’s easy to set up review queues that route specific documents to designated reviewers. These queues present new documents for review, correction, or rejection letting you ensure that all documents meet your policies and standards.

Define User Roles with Granular Security Settings

We’ve made the security setting around uploading documents very granular so that you can decide what each group does and does not have the authority to do. When we say granular, we mean granular! Decide if a group can scan and/or import. Decide what they can scan to – loans but not deposits, loans and collateral, and so on. And, even decide which document types those with permissions can use.

We work with banks and credit unions across the US so we know how careful you must be incorrectly adding documents to your document imaging system. Our tools will have you covered.

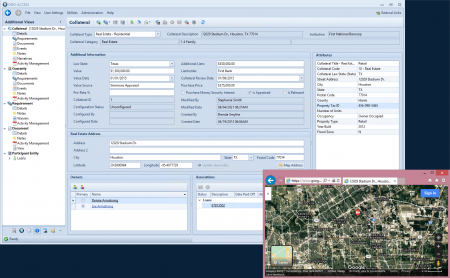

Automatically Clear Exceptions by Uploading Documents

We connect document imaging with exception tracking. We call it: exception tracking powered by document imaging.

Most banks and credit unions have a document imaging system and an exception tracking system or spreadsheet. This means they have to keep two systems and two processes in sync and up to date. All too often this leads to mistakes, frustrations between lenders and account officers, and loan and deposit operations and is time-consuming.

We connect these processes. With PROFORMANCE, you can:

- upload a document to archive it to your imaging system

- route the document to a quality assurance queue (optional)

- automatically clear an exception based on the presence of the document

- remove the exception from lender/account officer work queues in real-time

- remove the exception from paper management report in real-time

- update the date which the next customer notice will generate requesting recurring documents or update the date which the next customer email will generate to digital collect documents

And all this is powered by PROFORMANCE’S solutions. Think of the time your bank or credit union will save with an integrated process.

Quickly and Easily Image Large Loan Packages

Our document imaging system allows you to quickly and easily image large loan packages. We offer a variety of solutions to get all types of loan packages – especially complex commercial loan packages – into your imaging system. Our production scanner tools with barcode readers will get your loan packages in the archive in a snap.

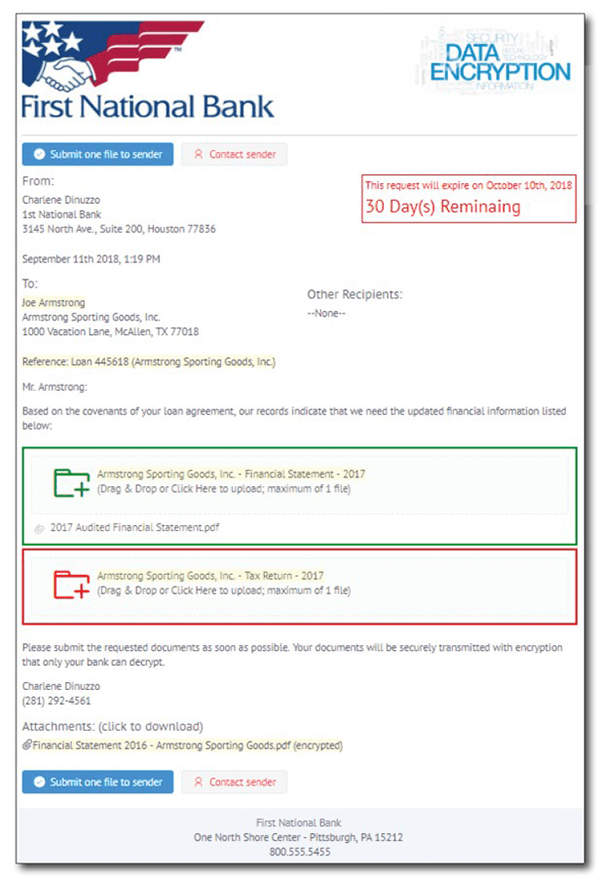

Send Customer Letters or Emails Automatically as Documents Expire

Maintaining ongoing documentation for customer and loan files – like tax returns, financial statements, proof of insurance, and more – is time-consuming and tedious, but it’s critical to your operation and credit quality. With PROFORMANCE, you can automatically generate paper notices or secure digital document collection emails that are sent to your customer requesting updated documents. Customize the notice templates and accelerate one more process for your team.

Use Our Storage or Bring Your Own

We have clients that want to keep their existing document management system, like OnBase or Synergy, and lay our solutions on top to unlock the workflow and automation tools above, and we have clients that want to convert to a new document storage system. Our solutions can stand alone as their own document management system or they can integrate with your existing document management system depending on your institution’s needs.

Finally Implement Document Retention

Proper document retention is complex and many banks and credit unions struggle to properly purge documents based on their retention schedules. Our document retention modules that allow for rules-based document purges with pre-review simplifies this process so that your bank or credit can make sure you are only keeping documents in file that are necessary.

Document Imaging by PROFORMANCE

A document imaging system built to accelerate your operations can streamline processes for everyone in your bank or credit union. If you’re interested in starting a discussion about how to improve your imaging, exception tracking, collateral management, file collection, and more, contact PROFORMANCE today!

We’re passionate about document imaging; learn more about document imaging on our informational page.