Jan 15, 2020

Jan 15, 2020

Improving the Commercial Loan Underwriting Process

From community banks to large financial institutions, business loans are an essential part of profitability. Connecting businesses with the right financial funding is the starting point for the community’s economic growth.

A chief complaint among borrowers is the delay due to the commercial loan underwriting process. With increasing regulatory burden and old systems, the entire process needs overhauling.

Let’s take a quick look at some simple methods you can put into place that will help ensure that there are no errors or delays in the process.

Commercial Loan Underwriting Process

The time between business loan inquiry to approval can be long, but collecting complete documentation from your borrower upfront can cut down on delays. There are three main things that every financial institution and lender will want to know.

Background Information

This portion of the process encompasses everything from credit history to the borrower’s business history. Many financial institutions and loan underwriters want to know projections for the future of the borrower’s industry and their business.

Other information such as all possible liabilities, what contingency plans are currently in place should the projections fall short, and who will guaranty the loan and what financial strength they supply are critical in making a prudent lending decision.

Repayment

Let’s face it; no financial institution is in the business of giving away millions of dollars just for the fun of it. Timely repayment of the principal and interest are vital to continuing operations.

A detailed financial ratio analysis is often required to help determine a business’s ability to repay the funds loaned. There is also the debt/equity ratio, which helps to determine the financial stability of the borrower. And when it comes to repayment, there are turnover rates to consider. The analysis of turnover rates explains how quickly the borrower can move/sell their product.

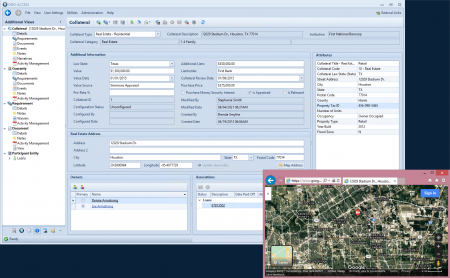

Assets

When lending large sums of money to businesses, the possibility of the borrower defaulting on their commitments must be considered. This reason is why most underwriters require collateral to be pledged. By ensuring loans are appropriately secured with current or fixed assets, the financial institution knows that should a business default on their loans; the institution won’t be totally out of pocket.

Delays Creep In

Providing adequate documentation of the creditworthiness for a complex deal produces, as you can imagine, a pile of paperwork — each document needs to be reviewed and picked over. The number of hands underwriting files must go through to complete the underwriting process is time-consuming, and discovering documentation is missing during later stages can cause all sorts of delays when lenders and underwriters must keep going back to the borrower to collect missing information. This is why there is a great need for improving the commercial loan underwriting process.

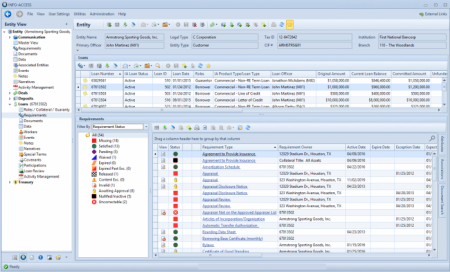

Using One Updated System

Here’s hoping you are not one of the financial institutions still working off outdated systems, systems you’ve outgrown, or through email only. Sadly, there are still a few. The benefits of updating your processing systems cannot be stressed enough, given the quantity of data needed to make a decision and ensure regulatory compliance.

Communication between departments is crucial to streamlining the process. There is nothing more frustrating for a borrower, lender, or underwriting than to have to access multiple touchpoints to find out one answer or to lose confidence in the process because of unorganized requests for documentation by lending staff.

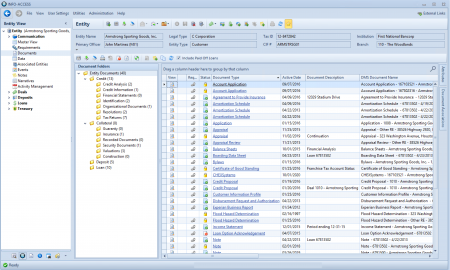

Utilizing an ECM (Enterprise Content Manager) in conjunction with your other applications, you can cut down on miscommunication and increase the functionality of workflows.

Most ECM’s can integrate with CRM’s (Customer Relationship Manager), ERP’s (Enterprise Resource Planning), and lending workflow systems that help guide the loan information and documentation request from application through to loan booking. With this sort of system in place, you will find that there is less time between the application submission and the decision point of the process.

Customer Experience

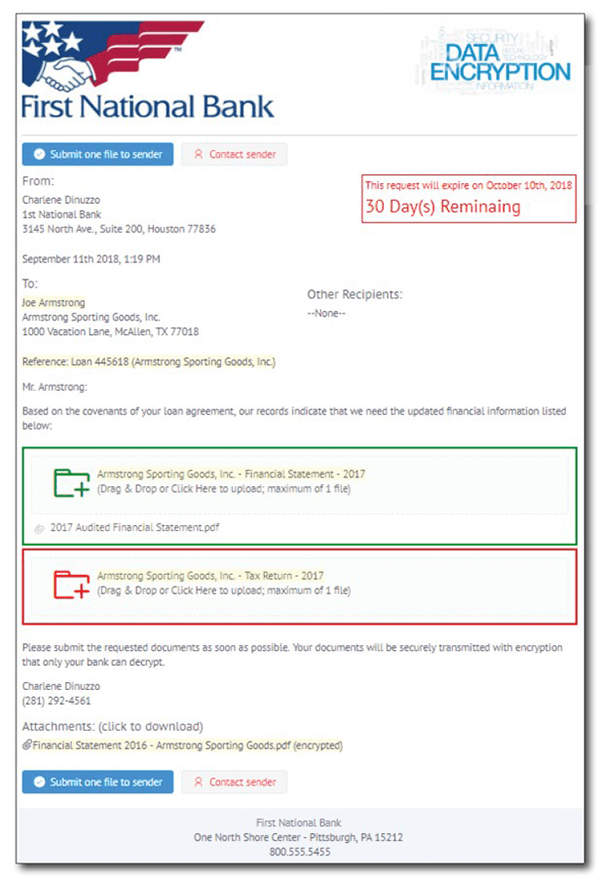

With so much competition for quality borrowers, your lending institution must find ways for you to stand out as the lender and financial institution of choice. The best way to do this is to give customers an easy, modern, streamlined experience.

Give your borrowers thorough documentation requests at the start with the ability to send documentation quickly and securely via a document sharing portal that funnels the information from your customer right into the underwriting software. Use a centralized system that seamlessly syncs new and existing loan information, documents, decisioning, and credit packages for use across the entire underwriting team to keep your customer’s deal moving efficiently through the process.

The commercial loan underwriting process can be convoluted, but we are here to help. For more details, check out our website and let us know how we can take your lending processes to the next level.